October 2017

Table of contents

- President's Message

- GPAC/PJVA Annual Joint Conference

- Canada Action

- EARLY MORNING SESSION - "Mutual Consent"

- “ENERGY TOMORROW: Canada In the World's Energy Future”

- Quit Claims and Why We Care About Them

- Federal Government Needs To Clarify Its Priority On The Future Of Hydrocarbons

- Social Report

- Upcoming Events

President's Message

As I alluded to in the September Newsletter, the PJVA Board of Directors meet to discuss ongoing business matters and design a strategy for new business initiatives. We work diligently to propose goals that are timely and consistent with Industry needs and the three main pillars of our base business, namely:

- Agreements;

- Education; and

- Networking.

Within those pillars, we create and manage joint venture model agreements, joint venture education (seminars, certificate programs and online courses), industry best practices, networking forums, and we oversee 100+ driven volunteers who provide their time and effort to make PJVA an exceptionally well known and effective association.

This year we built our strategy to “RESET”. We plan to focus on our PJVA brand and on our base business. This year, our strategy is to ensure alignment between our model agreements, our courses and seminars and update or edit where appropriate. As well, we will be continuing to work with like-minded associations to collaborate more and leverage efficiencies in course offerings and seminars as appropriate.

PJVA looks forward to the challenges ahead! And, we are always in need of more volunteers. If you would like to volunteer to help us with any of this work, please reach out to our Volunteer Director, Scott Wolfson, or myself, at your convenience.

Tracey Moore-Lewis (Enerplus Corporation) President, 2017-2018

GPAC/PJVA Annual Joint Conference

Due to a lower than usual registrations and sponsorships, the 2017 GPAC/PJVA Joint Conference is being POSTPONED TO 2018. Further details to follow.

Canada Action

Cody Battershill and Canada Action invite you to join the positive discussion surrounding Canadian resource development in the interest of improving the lives of all Canadians.

invite you to join the positive discussion surrounding Canadian resource development in the interest of improving the lives of all Canadians.

They are calling all volunteers and inviting you to attend a volunteer coordination kick-off event. Participate in interactive stations, hear resource positive speakers and network on Thursday, November 2, 2017 at FORT CALGARY – 750 - 9 Avenue SE from 6:00 pm – 8:00 pm.

RSVP to attend at Info@canadaaction.ca or go to http://www.canadaaction.ca/ for more information about Canada Action .

.

EARLY MORNING SESSION – September 27, 2017

'MUTUAL CONSENT'

The Early Morning Session held on September 27 was moderated by Kyla Ulmer who is a JV Contracts Analyst at ARC Resources. She has been with ARC since 2009 and has held various positions in JV and Royalty Accounting.

At the EMS, Kyla presented the topic of 'Mutual Consent' focusing on the importance for Joint Venture Contracts Analysts/Administrators on verifying the terms of agreements. The topic of discussion focused on service Agreements, revisions of exhibits and dispositions and what current industry standards and practices are in place. This EMS had a little bit a different format in that there were no overhead slides which I found worked really well in creating an open dialogue environment for the audience. Kyla did an excellent job by posing many engaging questions to the PJVA members such as “Mutually agreed upon, what does that mean?”, “What documents does an Operator need to send when selling out of an area?”, “What is the responsibility of non-operators?”, “When are ROFRs exempt?” to name a few.

Kyla really encouraged audience members to discuss what processes were currently being used at their companies which led to some very interesting and detailed conversations. There was no agreement reached on what clauses and documents were required for mutual consent, but more importantly, our members asked several questions and had an open discussion forum with the speaker and audience members, which made it a very successful EMS. The PJVA members really enjoyed the session and we were very lucky that Kyla, such an experienced and knowledgeable industry leader, was able to volunteer her time to present to us.

The next Early Morning Session will be held on October 25th which will be on Quit Claim Provisions. Are there quit claim provisions in CAPL operating procedures, or is this just a general article of law? Can a simple letter stating that the company is quit claiming their rights to a well and the interest in a facility to the Operator and other well owners result in the company no longer having an interest in either the well, or facility?

Would an agreement be required to legally transfer the two working interests? This topic will be presented by George Lepine from Enernext which is a boutique legal and advisory platform focused on energy, cleantech, sustainability, environmental compliance, liability and risk management and strategic planning.

Thank you,

Jonathan Cassetta

October 19, 2017 Luncheon Summary

"ENERGY TOMORROW: Canada In the World's Energy Future"

"We live in a growing world that's going to need more energy.

There's no doubt that we are going to see renewables and new alternatives supply a growing part of this energy. In fact, they are expected to grow more than 400% in the coming decades. But it's also clear the world is going to need more oil and natural gas for a long time."

With these words Jeff Gaulin, VP of Communications at CAPP opened the panel discussion at the October 19, 2017 PJVA Luncheon at The Calgary Petroleum Club. The panel was made up of Leaders of Canadian Oil and Gas Associations: Tracey Moore-Lewis, President of PJVA, Larry Buzan, President of CAPL, Tony Cioni, Past Regional Director of AIPN, Kody Carroll, Education leader at PASC and Josh Carter, past President of PJVA.

"We live in a growing world that's going to need more energy.

There's no doubt that we are going to see renewables and new alternatives supply a growing part of this energy. In fact, they are expected to grow more than 400% in the coming decades. But it's also clear the world is going to need more oil and natural gas for a long time."

With these words Jeff Gaulin, VP of Communications at CAPP opened the panel discussion at the October 19, 2017 PJVA Luncheon at The Calgary Petroleum Club. The panel was made up of Leaders of Canadian Oil and Gas Associations: Tracey Moore-Lewis, President of PJVA, Larry Buzan, President of CAPL, Tony Cioni, Past Regional Director of AIPN, Kody Carroll, Education leader at PASC and Josh Carter, past President of PJVA.

One of Jeff Gaulin's observations was that after three years of tremendous disruption in the Oil and Gas Industry, even if prices rise, the industry will never be the same. He called for changing Canada's relationship with our number one customer – the United States. He pointed out that today Canada is not connected enough to the world and we need the energy infrastructure to reach more customers and..…"We need to respond to disruption with intentional change …by driving operating costs down …and keeping them down"

He also pointed out that "The world is not just in an energy transition, it's in an innovation transition….It was innovative Canadians who found a way to get the oil out of the sand. And I believe innovative Canadians will get the carbon out of the barrel."

One of Jeff Gaulin's observations was that after three years of tremendous disruption in the Oil and Gas Industry, even if prices rise, the industry will never be the same. He called for changing Canada's relationship with our number one customer – the United States. He pointed out that today Canada is not connected enough to the world and we need the energy infrastructure to reach more customers and..…"We need to respond to disruption with intentional change …by driving operating costs down …and keeping them down"

He also pointed out that "The world is not just in an energy transition, it's in an innovation transition….It was innovative Canadians who found a way to get the oil out of the sand. And I believe innovative Canadians will get the carbon out of the barrel."

Jeff left the audience with an inspiring thought…"Certainly the world is changing. But our industry can turn adversity to advantage. On our country's historic 150th anniversary, it's worth all of us in this room to think about this opportunity. There is a long-term future for Canadian oil and natural gas, if we compete for it."

The Panelists weighed in with the following questions on the challenges to the Canadian Industry.

Jeff left the audience with an inspiring thought…"Certainly the world is changing. But our industry can turn adversity to advantage. On our country's historic 150th anniversary, it's worth all of us in this room to think about this opportunity. There is a long-term future for Canadian oil and natural gas, if we compete for it."

The Panelists weighed in with the following questions on the challenges to the Canadian Industry.

Why is it Canada still hasn't found a diversified market? Why haven't we differentiated our product - as green gas? Or maybe the most environmentally responsible? Or maybe as conflict free oil? Is there a permanent downturn in the CDN market?

How must we adapt our training programs? What does our community and workplace culture really look like?

With foreign investment leaving Canada- seeking lower risk, easier regulatory, what will collaboration look like in the future?

What do we do now that we are in the middle of Land Expiries?

What about access to new North areas – have we had development in Aboriginal consultation?

With new Green Energy Projects, there is a growing need for more Petroleum Surface Landmen to handle projects rather than Mineral Landmen. The session closed with a few questions from the audience.

Mr. Gaulin's presentation will be posted on the PJVA website under past luncheons.

Quit Claims and Why We Care About Them

Quit Claims. Over the years the term has come up but never really been defined or discussed. I had been wondering why I had been told over the years "just quit claim our interest to them". No explanation, nor idea given on how to do it. Now I know why. Everybody has heard of it, but nobody knows anything about the practical side of it.

A bit of history. I recently ran into a situation where "a friend of mine" had been sent a letter saying that company A had quit claimed their interest in "the well" and as such had automatically quit claimed their interest in the associated processing facilities. In discussing it with people who had been with the company longer than my friend it appeared that this was an old situation that had never been resolved. My friend asked me to look into it and get back to him/her/it with an answer. Easier said than done. Nobody I asked had any experience with a quit claim. All had heard of it, but no practical knowledge.

After researching it a bit on line and in the Black's Law Dictionary® I found a lot of information on quit claiming in real estate, but nothing about oil and gas. The only thing I found directly related to oil and gas was a downloadable ($$) model agreement. I finally relented and bought said agreement model and read it. I had heard that a quit claim is a conveyance agreement with no representations or warranties as to the rights conveyed (thanks Ashley Weldon for that). To have a valid quit claim, there must be two (or more) parties and there must be an agreement signed by all parties. Essentially a meeting of the minds is necessary. A seller or Grantor and a buyer or Grantee to the transaction where the seller offers and the buyer accepts the interest. Because it is assigning an interest in real property it must be properly referenced and if there are any accompanying facility/infrastructure interests being assigned they must also be referenced. And there must be money changing hands. $1.00 and other valuable consideration, receipt of which is hereby acknowledged.

To make a long story shorter I told my friend that unless company A can provide proper documentation showing that both parties agreed to and executed an agreement for the specific lands and mineral rights, and associated facilities, then company A is out of luck and still holds their interest and is still the owner and still has financial and other responsibilities as they had previously agreed to as a signatory to the lease or land agreement and CO&O.

Why is this important now? With the extended downturn in the price of oil and the absolute crash in the price of gas more and more companies are looking for ways to cut costs. Also, as wells and facilities age and are getting close to their end of useful life, companies want to get out of their abandonment responsibilities. One way is to pawn off their responsibilities to other owners by not paying invoices (we can discuss operator's remedies another time), or quit claim their interest in the wells/facilities to the operator or other owner(s). Quit claims are fine if done properly and accepted by both parties. But, if done improperly it can be (another) nightmare that we have to fish through to get resolved. Just ask my friend.

Marcel Savoie

MJ Savoie Joint Venture Consulting

Federal Government Needs To Clarify Its Priority On The Future Of Hydrocarbons: Dennis McConaghy speaking at September 13, 2017 PJVA AGM and Luncheon

"Canadian politicians — especially the Federal government — need to clarify where they stand on the future of hydrocarbons versus carbon," says retired energy executive Dennis McConaghy. "The Canadian Association of Petroleum Producers (CAPP) in its most recent supply outlook is forecasting Canadian crude oil production of 5.4 million bbls a day by 2030, including four million bbls a day of oilsands production, mainly in situ, while a recent forecast from BP plc indicates continuing global demand for Canadian crude, association members were told. Hydrocarbon emissions currently are about 725 megatonnes of CO2 equivalent annually and have been flat for about the past 10 years while Environment Canada is projecting emissions of between 700 and 800 megatonnes per year by 2030," he said.

"However, at the 2015 Paris Accord Canada agreed to a non-binding commitment of only 525 megatonnes per year of CO2e as part of the global commitment to limit the increase in the global temperature to 2 C," said McConaghy.

"It is utterly inconsistent to have an expectation that this [crude oil] industry . . . it is going to grow; that vision is inconsistent with a country that is going to commit itself to 525 and at the moment the Canadian government has not squared this circle. The federal government has committed itself to what I think are implausible targets but they also have never really come clean with Canadians about how much it would cost if we were going to take this target seriously or offered a way to get there," he said.

"In order to actually decarbonize the world," said McConaghy, "you would have to electrify virtually everything we use hydrocarbons for today and you would have to make the electricity from non-carbon sources. That could be wind, solar, nuclear and hydro, supplemented by massive improvement in battery technology to actually make the transformation work. The world would have to have a carbon price of $200 a tonne or higher to come anywhere close to having the economic drivers that force the kinds of electrification that is implicit in this aspirational target," he said. "If you are to take this seriously, it would take a massive intervention of governments."

"However, there is an alternative strategy of adaptation in which Canadians "sort of live with the risk" of a 3 C rise in the global temperature, using carbon prices as a way of becoming lower carbon," says McConaghy.

"The question is whether Canada is committed to a carbon reduction target at all costs or whether it is going to be a country whose carbon policy is defined mainly by pricing. That pricing should not be so dependent upon the target that it is out of step with what other countries are doing in terms of carbon policy — whether that is pricing or regulations that can be converted into a price," he added.

In Alberta, residents should also expect of their politicians that if they are going to have carbon taxes, they need to expect as a quid pro quo basic fairness from the rest of the country in the form of pipelines that would provide the market access to help benefit the national economy, according to McConaghy.

Social report

September 28th was the first fall pub night of the new PJVA season. We had a great turnout with close to 30 members in attendance at State & Main. Two door prizes were awarded to Richard Gushue and Hamsa Anand (restaurant gift card & PJVA camping chair) and some light appetizers provided by PJVA. Stay tuned for the next pub night event.

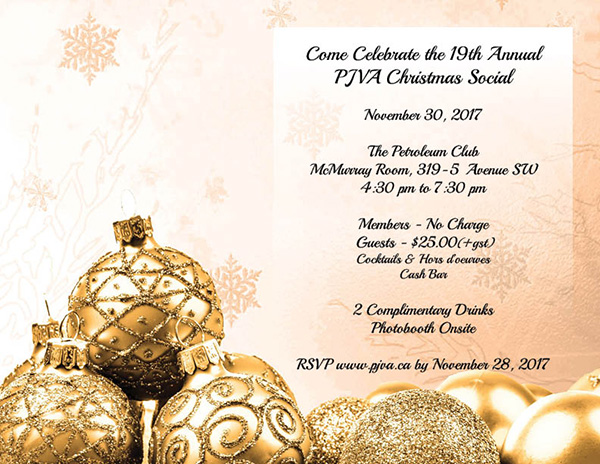

Please sign-up for the 2017 PJVA Christmas Social which will be held on Thursday, November 30th at The Petroleum Club. It's a great way to stay connected, network, catch-up with friends from the JV industry. Did you know that attending the Christmas social pays for more than 1/3 of your PJVA membership. Two complimentary drinks and light appetizers will be provided.

Upcoming Events

PJVA was incorporated in 1985 to represent individuals and organizations involved in petroleum joint ventures. JVViews is published to keep members informed about upcoming PJVA and industry events, courses and seminars offered and/or sponsored by PJVA and current projects being facilitated by the Association.