November 2018

November 15th Joint Luncheon PJVA and PASCCommunicating with the Agreements Task Force

24th Annual GPAC/PJVA Joint Conference

A Summary of the October PJVA Luncheon

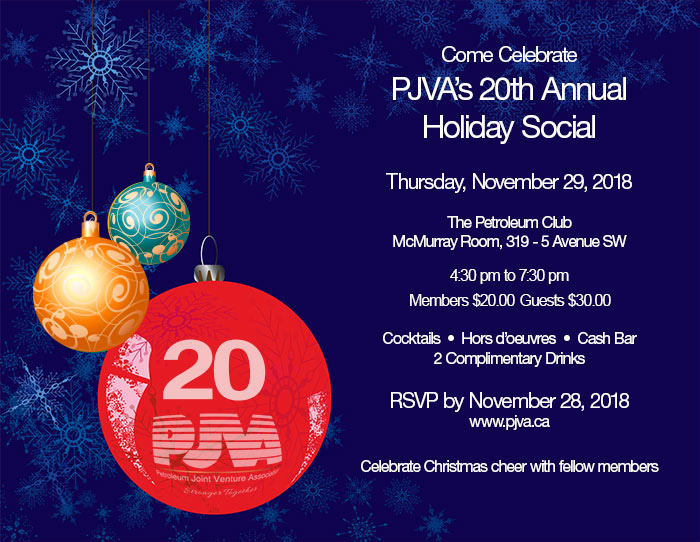

20th Annual Holiday Social – November 29, 2018

JV Certificate Program Course Material Reviewers Required!

Who’s On Board?

Alberta's Notley Proposes Ottawa get into the Crude-By-Rail Business

Air Liquide Canada Inaugurates New CO2 Recovery Facility Co-located at Greenfield Ethanol Plant

Remembrance Day

It's Renewal Time!

Consider a Corporate Sponsorship with PJVA?

November 15th Joint Luncheon PJVA and PASC

New technology – BOTS, AI, Smart Contracts. Revolutionary or Evolutionary?

New digital technology is promising to improve productivity. As we contemplate technology like Blockchain for the Oil and Gas industry, it's important to have a good understanding of how new technology can interact with our current systems. Joint Venture Representatives, Contract Analysts & Administrators as well as Joint Venture Accountants all use technology that is being impacted by new digital tech.

Our speaker Dave Howden had an interesting point to make in a recent interview. Question: We’ve seen a generational change in the work force. Will it affect how technology is going to be used? Dave’s answer: “I think many people feel that with generational changes, technology acceptance will accelerate. I can’t say that I have seen this in the work place. There are a lot of folks in my generation that embrace new technology and a lot of folks in the younger generations that don’t. Age is not the difference, willingness to adapt is. There was an article recently in The Economist that studied the growing inequality gap. One of the key observations was that workers who embraced technology were more valuable to companies and earned more. This will continue to be a challenge for all generations.”

Sponsored by:

Maureen McCall

PJVA Director- Programs-Luncheons

Communicating with the Agreements Task Force

Following up on a parting remark regarding questions on the Pad-Site Sharing Agreement which was rolled-out on September 25th, PJVA has created and will be monitoring the email address taskforce@pjva.ca. Please feel free to submit your questions and comments regarding the PSSA and/or any other agreements currently in use. We will be compiling and forwarding the comments to the various groups for response.

As the goal of this method is to make this process as easy on our volunteers as possible, we ask that you submit your questions/comments/suggestions in the following subject line format.

“YYYY Agreement – comment“

For example if you wish to have clarification around “seepage and pollution” insurance as mentioned in Article V, Clause 502 of Exhibit A to the PSSA please title the email by this same or similar convention.

“2018 PSSA – Exhibit “A” 502 “seepage and pollution”

On behalf of PJVA, thank you in advance for your comments,

John Downey

PJVA Director - Task Forces

24th Annual GPAC/PJVA Joint Conference

The conference began with welcoming remarks by Conference Director, Brad Hodges.

The morning keynote was presented by Doug Schweitzer of the United Conservative Party (Calgary-Elbow). Subjects covered during "Energy Policy in Alberta" included: Alberta's budget deficit, ideas about both the Carbon Tax and other taxes, proposed reform of regulations and ways in which the province should consult with First Nations groups as a means of persuading them to approve of development. He also suggested that there should be a referendum on equalization.

Cameron Gingrich of Solomon Associates spoke about North American NGL/Gas Supply and Transportation. Key points were made about: natural Gas production / developing costs, liquids - gas costs, long-distance transport of production and that small producers would be more competitive with large producers if they were to pool their resources.

Biju George of PwC Canada gave a presentation about Digitization Strategies Coming to the Oil and Gas Industry. There are a lot of changes taking place for many aspects, including production, administration and analysis. Digital will play a big role, and cost reduction is both a priority and a benefit. A number of technologies were named as examples: drones, AI, Internet Of Things, robotics, and Robotic Process Automation.

Mark Taylor, the EVP of Operations at the Alberta Energy Regulator gave a presentation about Climate Policy in Alberta. He began by describing the 4 key points of the AER's Climate Leadership Plan. In his opinion, Canada is a good performer, probably the worldwide best. The AER has 4 criteria/ questions when assessing: Cost effective? Adaptive? Operationally feasible? Transparent & credible?

Jamie Fisher gave a presentation about Altagas' Ridley Island Propane Terminal. The terminal is a joint venture operated by Altagas.

The JV partner is Vopak, and Altagas has aspirations to also export LPG, LNG, Methanol, and Diesel. Production is exported to Asia from the port at Prince Rupert. On the North American continent, Prince Rupert is the closest port to Asia. South East Asia is a growing market.

The lunch keynote was presented by Dennis McConaghy, former executive of TransCanada and now an author and commentator about energy. His presentation was about a year of frustration, Alberta and market access. He gave a detailed description of the obstacles which many pipelines face: Elbridge 3 and KXL need to make progress in the US courts, and the expansion of Transmountain faces a number of domestic obstacles. During my post-presentation chat with Dennis, the conclusion we reached was that negotiations with the US should be similar to a Joint Venture.

Kody Carroll, the President of Integrity Audit and Accounting Ltd gave a presentation with the title "F Word" - about fraud. He outlined many techniques used by fraudsters and highlighted many red flags that should be spotted. He finished by giving advice about prevention.

Rachel Kuhlman was unable to come to the conference because of a recent foot injury. The PJVA wishes her a full recovery and looks forward to meeting her in the future.

A panel of 4 gave a presentation about current challenges in Oil & Gas Mergers and Acquisitions. The presenters were Vivek Warrior, Duncan McPherson, Luke Morrison and Jana Pete who are all lawyers at Bennett Jones LLP. A lot of details and insights were provided by the panel: laws, advice, context, timing and insurance. All aspects should be taken into account when M&As are taking place.

Diane Porter of Absolute Infinity Inc. gave a presentation titled Building Resilience Through Diversification. A detailed presentation about building an effective and efficient team, description and advice was given about psychology, diversity, happiness and community building in a company. Combining all of these elements should improve a business's overall performance.

The conference finished with closing remarks by PJVA President, Richelle Lindsay.

***Thanks to the following participants:

Premier Sponsors: Joint Venture Strategic Advisors (JVSA) and Red Dog Systems

Media Sponsor: BOE Report

Crescent Point Energy Corp. for purchasing two corporate tables

Peter Mitchelmore

PJVA Newsletter Editor

A Summary of the October PJVA Luncheon - “Developing a Strategy to Improve Canadian Energy Competitiveness"

The October 18, 2018 PJVA luncheon began with a presentation by David A. McLellan, Principal at Ridgeway Strategic Consulting.

David shared his insights on US Trade, Tax and Regulatory reform and Canadian competitiveness. Early in his presentation he discussed US economic power, which has been diminishing as a global force since 1960. He mentioned that we are seeing a high rate of growth out of China, India and the emerging markets and even though the US touts the USMCA as a triumph, in terms of moving the American economy forward, it’s effect will be marginal at best.

As for the effect of clause 3210, the clause that stipulates “entry by any party into a free trade agreement with a non-market country shall allow the other parties to terminate this agreement”, McLellan thought it will complicate Canadian trade development with China. He believes it allows the US more control over Canada’s rights to negotiate other free trade agreements.

On the subject of US steel tariffs, David thought that the tariffs will impact every consumer of steel negatively. He mentioned that Canada has responded with 25% Tariffs on imported Energy tubular products when the level of those imports exceeds historical norms.

In terms of the Carbon Tax and Canadian Energy Companies, David McLellan’s perspective is moderate.

“We must agree a certain level of taxation is necessary, but whether is it taxed by Income, Consumption or Carbon is the question. I met with senior people at Energy majors in the US who surprised me. They said they are looking beyond Trump. They are preparing to get to a zero-carbon footprint on their timeline without it being forced on them in a real onerous way. In Canada, we are out in front by introducing a carbon tax early. At $50 a tonne it’s relatively innocuous but it is the rate of escalation that is a concern.“

In terms of new Canadian mega projects like LNG, he was hopeful. In McLellan’s words,

“I think Industry in the US and in Canada is looking beyond Trump. We must think that more rational people will once again be in charge and we can have our own independence in making trade deals. My biggest takeaways from this discussion is that people should realize American economic power is waning, they’ve gone from 40% of world GDP to 25%. It behooves Canada to increase trade with the rest of the world. We have to look beyond.”

Romeo Rojas, Associate at Bennett Jones also spoke on the changes in the Investment and dispute resolution provisions of the new USMCA trade agreement and we will cover his presentation in next month’s newsletter.

Maureen McCall

PJVA Programs- Luncheons Director

20th Annual Holiday Social – November 29, 2018

JV Certificate Program Course Material Reviewers Required!

Volunteers are required for the JV Certificate Program Course to review and update the course materials as follows:

- 6 month commitment – October, 2018 through to March, 2019

- 2 – 5 hours/week, varying based on work required and committee members available

- 5+ years’ experience with completion of the Certificate Program

- Ideal candidates for this role exhibit some or all of the following skills:

- Able to work in a confidential manner,

- Have current, relevant, industry experience and an understanding of the regulatory requirements in effect,

- The ability to identify, research and summarize information from various sources,

- Able to write new material, or edit existing materials, in a clear and concise manner suitable for use as an educational resource.

ALL interested PJVA members are welcomed to submit their names for either of these roles – your unique combination of experience, background, and skills might be exactly what is needed for the ongoing development of our course materials.

Who’s On Board?

Kevin Singh

Marketing

When did you get involved on the PJVA Board and why?

Summer of 2018 (July is when I started working with PJVA). It offers me a chance to give something back to the community. It provides an opportunity for myself to develop new skills and build on existing experience and knowledge.

Tell us about why you like the challenges of the joint venture business?

Joint venture business is a unique way of accounting which is very specific to the oil and gas industry. The challenge is in figuring out how to achieve transparency for all joint venture partners.

Tell us about the Marketing portfolio you’re responsible for at PJVA and the progress you have made over the last year or two?

I am responsible for the Marketing Portfolio. I am trying to solicit feedback from Board of Directors, Industry and Membership to improve/enhance marketing strategy for PJVA. I am brand new to the portfolio but in this period, was able to help with marketing of PJVA certificate courses for the Education portfolio.

What are your goals for your portfolio in 2018/19?

Establish a marketing budget for PJVA.

Determine and track performance metrics to assess effectiveness of marketing.

Provide monthly updates to Board on Marketing budget and ongoing initiatives.

Identify opportunities for joint marketing with other industry associations.

Best advice you ever received?

Don't let others manage your career.

Bradley Hodges

PJVA-GPAC Conference Director

Tell us about yourself.

I was born and raised in Calgary and have observed significant changes (both good and bad) in the city over the years. Upon finishing high school, I attending the University of Calgary and completed a Bachelor’s degree before getting my first job in the oil and gas industry as an intern in crude oil marketing. After my internship, I landed a job with an energy consulting firm doing market analysis and research. About three years later, my desire for further education led me to the University of Victoria as a full-time student in the school’s MBA program. After business school, I decided to stay in Victoria to work for the Government of British Columbia in the Ministry of Energy and Mines. While working on energy policy development for the government, I interacted regularly with Calgary-based oil and gas producers, including Shell Canada. With the goal of returning to Calgary and working in the energy industry, I applied for an economist role with Shell and asked my contacts from Shell to be my references. I was fortunate to get the job, and I continued with Shell in economics and joint ventures until the industry downturn in 2016. Since then, I have worked as a contractor and volunteer, including my PJVA board position. My wife and I enjoy spending quality time with family, friends and neighbors, and we take every opportunity to enjoy outdoor sports and time in the mountains.

When did you get involved on the PJVA Board and why?

In 2014 before becoming an official board director, I shadowed the conference director to become familiar with the board’s processes and responsibilities. I liked what I saw and ran to be the new conference director after our existing director went on maternity leave. I was always impressed with the PJVA’s courses, conferences and networking events, so it was a pleasure to accept a role on the board.

Tell us about why you like the challenges of the joint venture business?

The joint venture business encourages people to collaborate and solve problems for the better of the industry. Our Association’s motto is “Stronger Together”, and I believe we all benefit by fostering strong working relationships and finding “win-win” solutions with our joint venture operations and negotiations.

Tell us about the portfolio(s) you’re responsible for at PJVA and the progress you have made over the last year or two?

My responsibilities focus on organizing the annual joint conference hosted by the PJVA and the Gas Processing Association of Canada (GPAC). Over the past year, the conference committee has made progress on securing a more diverse line-up of speakers and revamping our sponsorship offerings.

What are your goals for your portfolio in 2018/19?

One conference goal is to attract additional attendees from professions beyond joint ventures and engineering, both of which have traditionally accounted for the majority of our registrations. Since people employed in law, marketing, mineral land and midstream (among others) often work with joint venture professionals, we believe having a greater variety of conference speakers and attendees will enhance our brand and provide a more enriching conference experience.

Best advice you ever received?

Never stop learning and always focus on the positive aspects of life, even when times are tough.

Alberta's Notley Proposes Ottawa get into the Crude-By-Rail Business

*Article originally written by Lauren Krugel and published in The Canadian Press, October 22, 2018

A northbound oil train sits idled on tracks, stopped by protesters blocking the track ahead, in Everett, Wash., on September 2, 2014. (THE CANADIAN PRESS/AP, Elaine Thompson)

CALGARY -- Alberta Premier Rachel Notley is proposing Ottawa get into the crude-by-rail business -- at least temporarily -- so that producers in her province can get a better price for their oil.

"We are in the midst of putting together a specific business case that we'll be taking to the federal government late this week, early next week, where we lay out the specific costs," Notley said Monday following a meeting with energy industry leaders in Calgary.

Notley noted that Alberta heavy oil producers have been dealing with a punishing price gap between their product and U.S. light oil -- in the order of around US$40 to US$50 a barrel in recent weeks. "That means that more money is being taken out of the Canadian economy and sucked into American bank accounts," she said.

Absent new pipeline capacity connecting Alberta crude to international markets -- like the stalled Trans Mountain pipeline expansion to the B.C. coast -- Notley said moving oil on rail cars can be a stop-gap measure to help narrow the price discount. And she said Ottawa should step up to making it happen, noting the federal government won't be recouping $2.6 billion it loaned to Chrysler in 2009 to keep the automaker afloat and save jobs.

"Surely if Ottawa can write off $2.6 billion in tax dollars paid to the auto industry in Ontario, it can support our oil industry with smart investments to help close the differential and return billions of dollars to the Canadian economy."

While Notley did not provide a price tag for the proposed federal crude-by-rail investment, she said it would be significantly less than the auto writeoff. "More to the point, it's something that ultimately will be paid for by way of increased value to the federal government's own coffers, let alone to the economy," Notley said.

Keith Stewart, senior energy strategist with Greenpeace Canada, characterized the idea as "pouring good money after bad to subsidize oil companies." "Premier Notley should be working with the federal government to make Alberta the leader in green energy development that it can and should be," Stewart said in an email.

"Those are the jobs of the future and as a bonus they won't fry the planet."

Notley did not specify what exactly the federal investment might look like, but noted more rail cars and locomotives are needed. She was adamant that she is not suggesting that oil supplant grain shipments on the railways.

She said it's statistically safer to move crude through pipelines than on railcars, so looking to trains is "not the best outcome."

But the plan to triple the capacity of the existing Trans Mountain pipeline between Edmonton and the B.C. Lower Mainland is in limbo. Ottawa bought the pipeline earlier this year from Kinder Morgan after the U.S. energy company became frustrated with a litany of political roadblocks.

In August, the Federal Court of Appeal quashed Trans Mountain's approval and now Ottawa is working to fulfil the court's requirement to consult Indigenous communities and consider the environmental impact of additional oil tankers off the coast.

In the meantime, Notley said, rail can provide some short-term relief for landlocked Alberta producers. "There are some other ideas out there, but I think rail is one of the most immediate."

*The newsletter may contain material sourced from to third party websites. The material is provided solely as a convenience to you and not as an endorsement by PJVA of the contents on such third party Websites. PJVA is not responsible for the content of third party sourced material and does not make any representations regarding the content or accuracy of materials on such third party Websites, or the availability of such Websites. If you decide to access third party Websites, you do so at your own risk.

Air Liquide Canada Inaugurates New CO2 Recovery Facility Co-located at Greenfield Ethanol Plant

*Article originally written by Meghan Sapp and published in the Biofuels Digest, February 13, 2018.

In Canada, Air Liquide Canada officially inaugurated its brand new carbon dioxide (CO2) recovery plant last week, strategically located at the Greenfield ethanol plant in Johnstown, Ontario where it recovers raw CO2.

This truly unique plant is the only one in Canada with a Health Canada drug establishment license authorizing the fabrication, testing, packaging and labeling of medical grade CO2 in accordance with the requirements of the Canadian Food and Drugs Act, as well as the Good Manufacturing Practices (GMP) requirements of the Canadian Food and Drug Regulations.

*The newsletter may contain material sourced from to third party websites. The material is provided solely as a convenience to you and not as an endorsement by PJVA of the contents on such third party Websites. PJVA is not responsible for the content of third party sourced material and does not make any representations regarding the content or accuracy of materials on such third party Websites, or the availability of such Websites. If you decide to access third party Websites, you do so at your own risk.

Remembrance Day

This year’s Remembrance Day will be unique. At 11:00 am on November 11th, it will be exactly a century after the armistice, which led to the end of World War One and the treaty of Versailles being signed. Many individuals have served the country honourably in many conflicts for over 100 years, we thank them for their service and keep them in our memories.

Since World War One ended, the Canadian oil and gas sector has provided fuel during times of war and peace. Hopefully, economic progress will continue, and will continue to be powered by the Canadian oil and gas sector using PJVA model agreements.

Peter Mitchelmore

PJVA Newsletter Editor

It's Renewal Time!

Renew Your Membership

Don’t forget to renew your PJVA membership for the upcoming year!

PJVA’s annual membership fees are amongst the lowest within the oil and gas sector compared to some of our peers such as CAPL. PJVA membership provides great value for networking, social events, luncheon speakers, JV agreements and documents, membership directory etc.

Thank you to our Corporate Sponsors

Volunteer Appreciation and Board Meeting Venue |

Board Meeting Venue |

Interested in becoming a corporate sponsor? Please contact the PJVA office

Upcoming Events

PJVA/PASC Joint Luncheon

November 15, 2018

Early Morning Discussion

November 28, 2018

PJVA 20th Annual Holiday Social

November 29, 2018